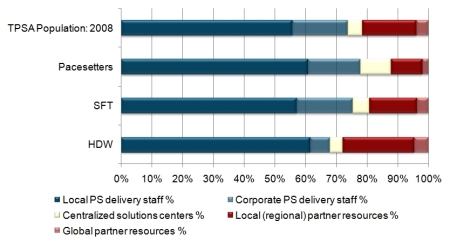

Earlier this year, I wrote about the bifurcation of sourcing strategies within embedded PS organizations. In this post, I discussed the fact that results from a new TPSA survey showed an emerging class of product companies that are deploying a much more leveraged model for sourcing services engagements. A model where centralized solution centers, local partners, and global partners play a key role.

We believe the trend to create leveraged delivery models will continue. Specifically, we expect PS organizations within product companies to aggressively leverage centralized solution centers, where a pool of delivery expertise is established in a centralized location and leveraged across multiple geographies. Embedded PS organizations are creating these solution centers for several reasons, including:

- To increase the ability to provide service offerings to low volume geographic locations, where it does not make sense to establish a large local delivery presence.

- To support low volume service offerings that are important to product adoption but not demanded enough to warrant training local delivery staff in delivering the offering.

- To drive consistent delivery methodologies across engagements throughout the world

- To accelerate the creation of unique expertise around emerging solutions.

- To provide a resource buffer for lumpy demand within each geography

Moving forward, we will be trending the resourcing mix of embedded PS organizations. We know from a multi-member study conducted this year, that a majority of embedded PS organizations have less than 5% of their delivery cycles being sourced from centralized solution centers. The image below shows results from that study for various peer groups.

Resourcing Mix for Embedded PS Organizations

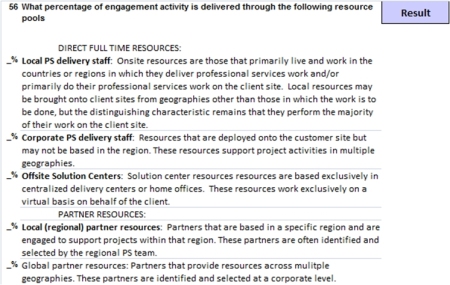

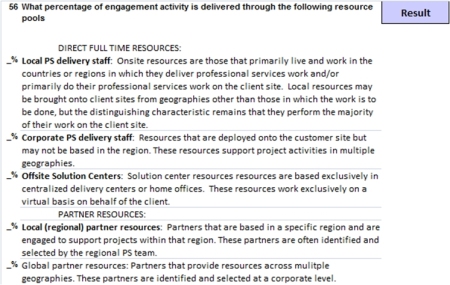

In November, we will be launching an updated industry benchmark study that collects thirty new data points related to the practices and results of PS organizations. One of the new questions will capture data on the resourcing mix as shown below.

New Benchmark Question on Resourcing Mix

At the Technology Services World conference next week, I will be reviewing the entire update to the TPSA benchmark study in the breakout session titled Comprehensive Update of the TPSA Benchmark Survey and Database:

Hope to see you in Vegas next week. If you are a fan of the blog and you are at the conference, make sure to introduce yourself.