A TPSA member forwarded an article in which IBM CEO Sam Palmisano was quoted as saying “Services has been a terrific story — we now have the best margins in the service business of anybody.” Now, I don’t know if Mr. Palmisano actually made this statement or not. I do know we track the services margin performance of the largest providers of technology solutions in the industry. IBM is on that list. and the data does not support the statement.

IBM has a very complex services portfolio, composed of everything from high margin software maintenance to lower margin outsourcing. The company does not break out the margin performance of each services line, so it is impossible to tell from the public data exactly what services margins IBM achieves on each service business. However, we do know what the blended margin is for the IBM services portfolio. We also know the blended services margins for other technology solutions companies. Every quarter we analyze this data and trend it. In the Q1 2009 snapshot, IBM once again dominated from the revenue perspective. The list of the top 10 companies in terms of services revenues is listed below.

| Rank by Services Revenue | Company | Q109 Total Tech Service Rev | Q108 Svcs % of Total Tech Rev | Q109 Svcs % of Total Tech Rev | Q109 Service Margin % |

| 1 | IBM | $ 14,332 | 53% | 54% | 33% |

| 2 | HP | $ 8,746 | 19% | 31% | 11% |

| 3 | Fujitsu | $ 5,447 | 60% | 53% | |

| 4 | Accenture | $ 5,266 | 100% | 100% | 31% |

| 5 | Oracle | $ 3,991 | 70% | 73% | 74% |

| 6 | CSC | $ 3,976 | 100% | 100% | 22% |

| 7 | Capgemini | $ 2,909 | 100% | 100% | |

| 8 | Hitachi | $ 2,709 | 10% | ||

| 9 | SAP | $ 2,700 | 54% | 60% | |

| 10 | Xerox | $ 2,039 | 47% | 49% | 42% |

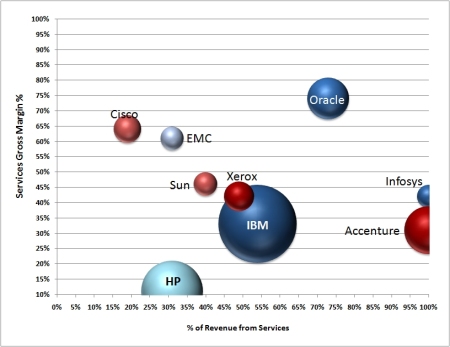

So yes, IBM dominates from a total services revenue perspective. But do they have the best services margins as claimed by Mr. Palmisano? Below is a graph with just a few of the companies in The Service 50. The graph maps the amount of total company revenues coming from services and the blended services gross margin reported in the public data. The bubble size is related to the overall size of services revenues.

IMAGE

The TPS Universe

As can be seen, IBM is the big planet in this technology services universe. However, they are not achieving the highest gross margins. The maintenance intensive service revenues of Cisco, EMC, and Oracle, and Sun allow them to achieve higher services margins than IBM. The labor cost advantage of Infosys allows them to achieve higher gross margins than IBM. Xerox , like IBM, offers a wide array of services—Xerox just achieves higher margins in the process. However, IBM is achieving better margins than both Accenture and HP (with EDS inside). In some ways, these may be the only two other planets IBM is concerned about in this universe of technology services providers. And maybe these are the competitors Mr. Palmisano had in mind when he made his bold statement.

Tags: IBM, service margins

October 7, 2011 at 8:42 am |

[…] be huge – certainly big enough to capture a significant amount of value created in the process. This blog post quotes data suggesting that e.g. Oracle’s services margins can be as high as 74%. For a […]

October 7, 2011 at 8:42 am |

[…] be huge – certainly big enough to capture a significant amount of value created in the process. This blog post quotes data suggesting that e.g. Oracle’s services margins can be as high as 74%. For a […]