When business slows, PS organizations begin scrutinizing billable utilization with renewed vigor. PS management is under increased pressure to justify both billable utilization rates and how non-billable time is being spent. Clearly, the concept of utilization is one of the key building blocks of any profitable professional services organization and billable utilization is a key indicator of staff productivity. However, professionals in the industry continue to debate the appropriate way to calculate and report this fundamental metric. What number should be used when determining the total available hours for each consultant? Should the total available hours be modified from country to country to accommodate variances in holidays, vacation, and work week policies? If there is no standard way to calculate utilization, how can geographies compare productivity?

As an industry association, TPSA will never completely put to rest the debate surrounding utilization calculation. However, TPSA does provide a recommend practice for the most effective way to calculate utilization across multiple geographies.

First of all, we need to provide the key definitions that are used when calculating and discussing the concept of utilization:

TotalAvailable Hours

Standard number of working hours available during a time period before vacations, holidays, or personal time off.

What baseline number should be used here is the greatest source of debate regarding calculating utilization? The most prevalent number used in the industry for total available hours available in a year is 2080. This number is calculated by taking the 52 weeks of the year and multiplying them by a standard forty hour work week. The next most standard number adopted by companies is 2000. However, some TPSA members do establish a unique number of available hours number for each country.

Billable Utilization Rate

Total number of hours billed during the period / total available hours for the period

Once a company agrees on the denominator of available hours, it should be relatively easy to calculate billable utilization rate—providing the company accurately records billable hours for each consultant. The challenge with this calculation concerns customer activity that is billed vs. unbilled. For example, if a consultant performs work for a customer but is not able to charge the customer for that time, it should not be added to the numerator of this calculation.

Productive Utilization Rate

Total number of hours billed + total number of unbilled customer project hours + total number of hours allocated to approved projects + total number of hours in training/ total available hours

Just because a delivery consultant does not bill an hour does not mean the time was misspent. Productive utilization rate tracks the percentage of time the consultant spends on approved initiatives and activities that do have value to the company.

Now that we have a common set of terms, I will outline four practices TPSA recommends regarding utilization calculation practices:

#1. Create common baseline number across all geographies

By basing all utilization calculations throughout the world on a common denominator, it becomes exponentially easier for the management team to easily understand the differences in geographic performance. Also, by establishing a common denominator, all finance and service operations staff will benefit from using the same exact process to calculate billable utilization. As previously mentioned in this article, the most common number in the industry to use for available hours is 2080.

TPSA acknowledges that some organizations, based on geographic location of billable resources, seniority of consulting staff, etc, will never have 2080 billable hours available. For these organizations, the achievable target billable utilization rates will be lower by definition. Understanding the realistic achievable billable utilization target for your PS organization is an important step in modeling the business.

#2. Create common categories

Secondly, TPSA recommends the PS organization establishes common categories for delivery consultants to track their time. Recommended categories for delivery staff to track their time include:

- Billable Time : Hours tracked against a customer project and billed to an external customer. Non-billable Customer Project: This would be activity performed for a customer but not billed. It is critical the PS organization tracks and quantifies this “sales cost offset” activity to ascertain the financial impact of such activity on PS financial performance and company financial performance.

- Training and Certification: Hours spent attending formal skills development training.

- Internal Project: Hours spent on approved internal projects such as solution development or product enhancement/fixing. Even if there is cost relief from another department for the use of the PS resource. The hours should be tracked in this category. The PS management team must understand how much time delivery staff our spending with customers as opposed to supporting internal initiatives.

- Holiday: Hours off for company holidays.

- Vacation: Hours off for personal vacation accrued.Other: Any hours spent that cannot be categorized in one of the five previous categories.

#3 Set billable utilization threshold per geography

TPSA recommends global PS organizations do establish specific billable utilization targets on a country or regional basis. This acknowledges the reality that economic and cultural variances will impact achievable billable utilization.

#4. Track productive utilization

Finally, TPSA recommends embedded PS organizations that support a product portfolio track both billable utilization rate and productive utilization rate. This comparison is critical during periods of new product release when billable utilization may fall due to support activities surrounding product rollout. However, productive utilization rate, if tracked, may actually spike higher as delivery staff find themselves working overtime to support a large product push.

Example: Calculating Utilization

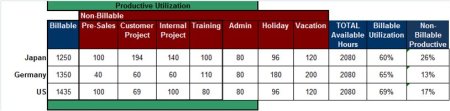

All of the concepts listed in this section are brought together in the image for this entry: Utilization Targets by Geography. In this table, you can see that the U.S., Germany, and Japan have each been given different billable utilization targets. Also, Germany is modeled to experience higher holiday and vacation time while Japan is modeled to experience a greater amount of hours spent on non-billable customer project activities.

Once again, TPSA will never remove all of the debate surrounding how billable utilization is calculated. However, by following these recommended practices, PS management can present a consistent methodology to help executive management understand billable utilization dynamics across multiple geographies.

Tags: billable utilization

December 3, 2008 at 5:15 pm |

Hi Tom,

This is a very informative post. This helps clarify best approaches to utilization. Can you share a few suggestions on capturing gross margin when dealing with full time salaried employees? Most systems compare hours to complete (labor costs) to revenue collected. Calculating the hourly cost of salaried employees based on a 2000 hour work year is obvious. The challenge is hourly rates can be quickly diluted when the employees work longer then 40 hour work weeks. For example the gross margin on a project that takes 100 hours to complete varies drastically if the labor was performed in one vs. two weeks for a salaried employee. Any insight or direction is greatly appreciated?

December 3, 2008 at 8:18 pm |

Jerry:

I don’t think I clearly understand the question.

Project margin = Project Revenue – Project Costs.

If project revenue = $20,000 and it takes 100 hours to deliver the project at a cost of $100 per hour, than the project cost would be $10,000 and project margin would be $10,000. Regardless if the 100 hours were applied over one or two weeks.

Is the problem that your project accounting not allow you to match actual effort to project revenues? Or is there something else you are struggling with?

December 4, 2008 at 10:32 am |

I’m struggling with the true cost per hour (this example $100). To get an hourly cost we plan on taking employees annual salaries and multiplying them times 122% (includes burden) and dividing by 2080. But if an employee worked and logged 60 hours in a week on a project and assuming you are not paying him over time you are still paying him the same as if he worked a 40 hour week. Granted the scenario hopefully will not occur too often and it probably balances out over time. But this particular project’s margin may be under stated by 20 hours x $100 if your true cost of the project was one week of work (40 hours). I hope this helps clarify. I was just curious if this concern has come up in the past. Thank you for sharing your ideas.

December 4, 2008 at 2:28 pm |

Let’s say the employee cost (fully burdened) is $100,000 for the year. Divided by 2080, the hourly cost is $48.

If an employee does 60 hours of work against a project, I would charge that project with $2,880 in cost (60 * $48). Even if you only paid them $1,920 (40*$48). This addresses several issues:

1. Allows you to understand the true cost and true effort associated with a project.

2. For billable hours, allows you to reconcile costs and effort with customer revenues.

If any of the readers out there have an opinion on this, please chime in!

December 15, 2008 at 3:41 pm |

[…] Muccio Thomas Lah, author of the Service Visions blog, was just telling me that his recent post on calculating utilization has been one of the more heavily read posts he’s ever written. This should come as a […]

January 28, 2009 at 12:48 pm |

My struggle is with calculating a billable utilization rate in cases where work performed that was initially assumed to be billable is later waived/treated as non-billable. Do you have any suggestions for how to capture billable vs. non-billable hours for projects where business decisions might retroactively move hours from the billable “bucket” into the non-billable one (or vice-versa)?

Thanks.

January 28, 2009 at 2:08 pm |

Pam:

I understand the challenge. I recommend customer work that initially was scoped to be billable and then was performed for no fee should be categorized as “Non-billable Productive” in the sub-category of “unbilled customer project.” This approach accomplishes several objectives:

-Keeps your true billable utilization calculation clean. In other words, you need to understand what percentage of time is truly revenue generating.

-Provides a place your consultants can use to get credit for doing productive customer work. However, make sure they are assigning this unbilled time to a specific and valid customer project so you can track what customer projects are accumulating excessive unbilled hours.

-Provides a way for you to start analyzing how big this problem is by tracking the amount of hours that are unbilled yet project related. If the bucket is big, you can justify an effort to analyze and address root causes. Poor project scoping? Sales folks promising too much? Product issues that require services staff to perform work for free.

February 4, 2009 at 10:36 am |

Thanks, Tom.

I guess more specifically my problem is in situations where time is already explicitly booked into our time tracking system (and reported on) as “billable.” After the monthly billable utilization numbers are published, some event occurs and those hours are now deemed to be unbillable. Do I recreate the previous month’s utilization figure and rebook the time to the “unbillable” (but productive) bucket? This seems like it has potential to become unwieldy and to cause the restatement of every month’s billable utilization ever reported.

February 4, 2009 at 6:14 pm |

Pam:

I agree, going back and rebucketing can be painful. I would recommend when billable hours are “debooked” because the customer does not agree to pay for the work, you create a new category called “write offs” to track these hours and the dollar amount. At the end of the quarter, when everyone hits their billable utilization target but the “write off” number makes the quarter less profitable, you will be able to show the correlation. Also, you could attach thresholds on your bonus payouts for the PS staff. They must hit their target utilization rates AND be under a threshold for hours in the “write off” category before payouts kick in.

March 18, 2009 at 12:42 pm |

I enjoyed your article. I have a question about whether or not admin hours should be included in “Productive Utilization”. In your definition the productive utilization rate does not include admin hours in the calculations. However, in your graph it implies that productive utilization includes admin hours (based on the green bar). Can you clarify whether or not admin hours go into productive utilization, and if so why?

In my mind, admin hours are essentially an “other” bucket, and I don’t feel it makes sense to include it in the productive utilization rate calculations. If you include “admin/other” hours in the productive utilization rate then the metric becomes less meaningful. Perhaps your definition of admin hours is different. Any clarification you can provide would be helpful.

March 23, 2009 at 3:54 pm |

Brent:

I agree with your comment. I would not classify admin time as productive utilization. The graph is not labeled correctly. Great catch.

April 6, 2009 at 3:01 pm |

[…] conversation on the challenges of managing embedded PS, he made the comment he had read my post on Calculating Utilization—and he wasn’t so happy. He liked portions of the guidance, but there is one recommendation I […]

April 12, 2009 at 10:15 am |

Thomas!

This is very thorough guidance. I liked it.

The next step would be guiding the consultants to deliver to this utilization target. I am consultant myself and know about utilization first hand ;).

What I observed in the field working with other consultants that many struggle to hit utilization target consistently. So i “developed” a simple system of “budgeting” my utilization hours for projects annually, monthly, weekly and then executing to the plan daily. It worked for me pretty good. I am not overwhelmed with work but still capable to hit my target and much beyond it. Would love to hear what you think about it

http://practicethis.com/2008/09/06/time-is-not-money-time-is-budget/

Thank you.

August 20, 2009 at 10:28 am |

If I want to calculate billable utilization each month, how would I handle vacation time? For example, I have 2 employees. Each employee is expected to work 20 days this month (5 days x 4 weeks). Let’s assume that the first employee takes two weeks vacation and the second employee doesn’t take vacation during this time. When I do the billable utilization using the formula you described above for the month, I would be surprised to see that the first employee had a very low utilization (because of the 2 weeks of non-billable time) compared to the second employee (assuming this person was doing billable work during that time).

September 29, 2009 at 1:19 pm |

We faced the same issue in developing our model, and I think there are generally 2 approaches:

1. Report actual utilization, and know that everyone will have “low utilization” months whenever they take vacations. It will happen to everyone, and the aggregated annual utilization numbers will average that out.

2. Subtract any vacation from the denominator, so that someone that worked 100% for 4 weeks would show the same as someone who worked 100% for 2 weeks. Essentially, both were 100% for the time that they had available. In this model, the annual targets need to be adjusted for allowed vacation time (i.e. reduce the denominator by that amount). The upside to this approach is that you can see comparative utilization levels across your tem. The downside is that you can’t compare your utilization levels with industry standard levels, which use 2080 (or similar) as the denominator.

We use method #2, and find that it works quite well, but we do suffer from the downside that I mentioned, although we can re-calculate our levels to be able to compare them to industry averages.

Hope this helps.

September 2, 2009 at 3:36 pm |

[…] the most popular blog entry I’ve written to date is the one that defines a standard method for calculating utilization for delivery staff. It has generated several comments and questions—a majority made directly to […]

May 18, 2010 at 11:33 pm |

I want to revisit comments that Jerry made earlier, my firm is experiencing something similar (I think). And I’m don’t really think that your previous answers addressed all of the nuances of his or my situation, but I certainly appreciate you trying. As background, we are a consultancy with fixed fee projects, note we do not bill hourly – this is where it gets confusing I believe. Traditionally we have measured the profitability of individual projects (the sum of each employee’s billable rate * their hours against the fixed project fees). However, while generally that can keep us on track it doesn’t actually equate or reveal the firm’s yearly profitability. For instance, each project may be profitable but we may not have enough projects to utilize all staff and hence costs are greater than revenue. So that suggests that utilization should be helpful. However, utilization alone can be misleading because high utilization may just mean that we’re putting forth more hours than our project is budgeted for (in which case the project profitability would be a better indicator). The best situation is actually that, without stressing an employee’s workload, that employee actually does the expected work in less time than is necessary and devotes that time to other revenue generating work – imagine working 2 projects in the time that just 1 was expected. Does my situation make sense? Is the crux fixed fee projects vs billable hours? Is there a single metric firms use? Or some good combination?

May 19, 2010 at 8:00 am |

Taylor: I think I understand the question. The tactic is to bring back the lens and model the economics of the entire labor pool.

Since PS is a human capital intensive business, you need to make sure the human capital is being utilized in a “revenue generating” way. One way to help do this is to calculate the base amount of billable utilization and revenue the entire delivery pool needs to achieve for the organization to meet profit targets for the year (or quarter).

For example, if you have 100 delivery staff right now, your overall profit targets may require them to achieve at least a 70% billable utilization rate at an average rate of $125 an hour, generating $18.2M in revenue. Every project you book chips into that $18.2M objective. And you are right, even though the individual projects may have high profit margins, the volume may be too low. At the end of the quarter, you have delivered three high margin projects but only made $9M in revenue–which means the overall profitability of the PS business for the quarter will be atrocious!

Hope this helps.

May 19, 2010 at 8:34 am |

In my experience, utilization works well and can be the primary tool for measuring the performance for organizations that utilize per hour billing, but utilization doesn’t tell the entire story when you are dealing with fixed price projects.

Therefore, we use utilization to make sure our staff are working on enough billable projects. We also look at budgets vs actual to see if we are completing the work in the amount of time that was budgeted. When a project is over budget it is important to try to understand the reasons and try to prevent them in the future.

May 19, 2010 at 12:11 pm |

In my experience of running a professional services firm, I believe that both utilization and billable rate are relevant and important, and lead to the key metric of revenue generated (as Thomas said). High utilization levels without looking at billable rate can be misleading, and the same with high billable rates but not enough work. From my perspective, this is not about measuring for the sake of measuring, but more from the ability to take action, and seeing all 3 metrics is key to identifying the root of any issues.

For our firm, we calculate and present all 3 metrics: utilization level, billable rate, and revenue generated, with each of those compared to targets (at the firm, practice and individual levels).

As one of the above comments suggested, our approach is to remove non-work time (vacation, sick, etc.) from the denominator, which helps to report true utilization levels. This is for ongoing measuring and reporting. To compare with industry standard levels, you can still easily do another calculation that uses 2080 (or similar) as the denominator.

For fixed-price projects, we “re-calibrate” our hourly rates (for reporting) according to actual hours applied. By doing so, the (billable hours X hourly rate) always equals actual fixed-price revenue. This approach helps to highlight projects that are performing above or below estimated hours, since the reported billable rates will be higher or lower than targets.

In response to Jerry Fain’s struggles (with calculating true cost in cases where someone works more than 40 hours per week), we base the hourly cost on what we expect the individuals to reasonably and realistically work in a year. Then, if someone does work 60 hours in a week, then the true “cost” is really (60 X hourly cost), since I expect that person to “make up” for that in later weeks or months (i.e. work a few “lighter” weeks). The key is to determine a realistic number of work hours – if most weeks are 40 hours, but 10% are 60 hours, then the true hours per week (for determining hourly cost) is 42, not 40. Also, keep in mind that the billable hours have to cover the cost of both billable and non-billable hours, so we actually use a “cost per billable hour” to help measure true profitability (i.e. someone’s cost may be $40/hour, but if they only bill 50% of their hours, then their cost for each billable hour is really $80/hour.)

I hope this helps. I haven’t found any good resources for how other professional services firms do all this, so have had to figure some of this out on our own. David Maister (http://davidmaister.com/) has great info for professional services firms (definitely read his books), but not this sort of tactical info on measuring/reporting utilization, rates and revenue.

October 11, 2010 at 3:09 am |

[…] Here are some questions Lah raised in the blog “Service Visions: Framing Technology Professional Services” […]

October 10, 2011 at 6:31 pm |

Thomas,

Referring back to your response of 12/4/08 to Jerry, would you then add that extra 20 hours to the numerator, still dividing by the same (2080 per year) denominator to result in a higher Utilization or add it to both numerator & denominator, thus not altering the Utilization as a result of those extra hours worked?

October 22, 2011 at 5:56 pm |

Where can I find the industry standard for utilization rates for a Public Sector Consulting Company (100 Employees)

October 23, 2011 at 12:44 pm |

Michael:

Touch base with Unanet. They provide PSA software to many firms that work in the public sector. They may have data there. We (TSIA) don’t track the pure play consulting firms.

http://www.unanet.com/

November 29, 2011 at 5:06 pm |

I recently ran into this issue while implementing PSA at a client and would love to hear some opinions on best practice. The issue was that like mentioned above, vacation/holiday time was removed from the available hours in the denominator. The problem came when the consultant mis-entered their timecards and over-reported the exempted hours.

For instance, assume that a US employee on Christmas week was scheduled for vacation but for whatever reason actually ended up working 4 hours that week anyway. The math ends up looking like this:

Billable Hours: 4

Available Hours: 40

Exempted Hours: 40

Utilization = 4 / (40 – 40)

This becomes a divide by zero problem, but should the “true” utilization be 100% or 0%?

In our discussion we believe the “correct” answer to be 100%, because the hours should have rightfully been entered like this:

Billable Hours: 4

Available Hours: 40

Exempted Hours: 36

Utilization = 4 / (40 – 36)

Utilization = 100%

However, one of the reporting systems automatically set utilization to 0% if the net available hours was 0 or less. The PSA system set utilization to 0% if the numerator was 0, but if the denominator was 0 or less, it set it to 100%.

Is there a general consensus on what the “most correct” utilization should be in this case?

January 22, 2012 at 6:18 am |

Hello. Am very interested in this string. I am a partner in a small consultancy and we don’t have a problem defining or measuring utilisation per se (well, our measurement is slightly imperfect but we get a good indication – good enough to be directionally correct, if not perfectly accurate), and we use it as one of 3 metrics – like others above – alongside fee-rate, and revenue to help provide useful data for our firm. However, the challenge keeping me awake right now is what to infer from the data if it changes significantly. Our utilisation rates are already quite low compared to other management consultancies but this has been a deliberate strategy over the last 40 years and we have been profitable and successful. However, over the last 4 years, our UTR has declined significantly below our target. My sense is that if UTR is continually declining beyond our targets, then we have an over-capacity problem. There is quite simply not enough work to go round. Of course the external market conditions are very tough in the consultancy market and revenues and demand have dropped – so of course we see a drop in UTR, but my question is to what extent do we act on this? We want to be sustainable and invest in building a solid stock of consultants who will grow our business and be ready to hit the ground running as the economy recovers and deliberately reducing headcount is too drastic a measure – but at the same time, paying for extra capacity when the demand is there is a tough one. We have a severe distaste within the practice to reduce headcount and we have a fervent belief in ‘sustainability’ but at what point do you act on the numbers?? For me, UTR isn’t just a measure but also an indicator…

Any thoughts?

January 22, 2012 at 3:05 pm |

Deborah:

This is a tough one. The dance between supply and demand is always challenging for a human capital intensive business.

Two thoughts: 1. Analyze your bookings forecast to determine if you do believe revenues are on the upward trend. This would help make the argument for retaining talent and absorbing lower profitability in the short term. 2. Leverage a “warm” bench of sub-contractors. Many firms are establishing subs or “1099” employees that can be booked into projects when they become real. However, these resources are not fulltime staff so you do not incur the expense when there is no billable work.

November 19, 2012 at 5:11 pm |

Does anyone set billable target %s by service area? If so, what methodology do you use.

November 19, 2012 at 9:37 pm |

What exactly do you mean by “service area” ?

November 20, 2012 at 6:56 am |

By service area, I mean area of expertise (i.e. writer, designer, strategist, etc.). My firm builds custom solutions for our clients and I am evaluating the value of having different billable rates for the different areas of the business that have a distinct role in building the solution to help develop workforce planning models.

November 20, 2012 at 8:30 am |

Then the short answer is “yes.” PS organizations often set different billable targets for different roles. For example, senior Solution Architects may have lower billable targets because they are heavily involved in pre-sales activities. I hope that helps.

December 14, 2012 at 5:21 am |

I am interested in the 2080 baseline merit.

Globally, available hours (working hours per week, times 52, less holidays and PTO) varies significantly. In the US, I believe it is 1880 whereas in Denmark, the equivalent number is 1643 (37.5 hour week, 30 days PTO, 12 holidays).

This creates an available hours variance of 237 which is over 14% of the available hours in Denmark.

So, the TSIA recommendation is 2080 and variable targets. I presenting comparable util figures across countries, each countries absolute util would need to be expressed as a function of its variable target which, to my mind takes me back to the same place I would be if I varied the baseline by country in the first instance ( against the TSIA recommendation).

I am far more interested in comparable performance across markets, than in having a number that I can compare our global performance against other embedded PS orgs. And so I wonder what other benefits I might be forgoing, or complications I would be creating by implementing a variable baseline rather than 2080.

Is the TSIA recommendation for 2080 somewhat influenced by the proportion business its members conduct within the US? Or are there other compelling justifications?

December 15, 2012 at 8:50 pm |

Craig:

The 2080 is not influenced by a “U.S.” perspective. By evaluating all regions against a 2080 base, you understand the true cost of sourcing services from that region compared to other regions. This is relevant to service organizations as they globalize their sourcing.

April 3, 2013 at 7:05 am |

Thomas:

When reading your article, i was – just like Craig – puzzled by the baseline definition: I still do not get the full reasoning behind applying the 2080 available time baseline accross regions and the link with global benchmarking. It would seem more reasonable to measure real productivity of staff against their available time (as defined by local work schedules) as a measure of “efficient / billable use of their available time”. This measure can be compared across regions to define where to source “efficient” services. Could you please elaborate more on your reply of Dec 15, 2012 ?

April 3, 2013 at 1:22 pm |

Stijn: Thanks for the question. I replied in my most recent post.

August 28, 2013 at 8:13 am |

Calculating utilisation is key to understanding resource planning, but as an aside, do you think it can/should be used as a KPI for Consultants?

I am being asked to measure my Consultants on 3 measures:

1) Billing Rate : Achieving a set % of ‘billable hours’

2) Utilization Rate : Achieving a set % of ‘billable hours + value added internal projects’

3) Realization Rate : Achieving a set % of ‘estimated hours vs actual hours’ as we do a lot of ‘fixed fee consulting’

However, my challenge… Is it realistic to target a Consultant on 1 & 2 as it is out of their hands. They can only achieve billable hours if Sales are selling the products & services that need a Consultant. The only thiing that they have full control of is ‘realization rate’ as they dictate the time required and then perform the services needed.

What are yours or others thoughts on that?

August 28, 2013 at 12:48 pm |

Stewart:

Billing Rate and Realized Rate are very hard for an individual consultant to control since they typically have no say in the final discounted price of an engagement. I would not use these two metrics to evaluate your delivery consultants. However, billable utilization is a fair target. As long as your product is actually selling, Your sales force and your customers will keep good consultants busy. Also, you want your consultants to be focused on staying engaged with customers. We benchmark what embedded PS organizations use in the variable compensation component of delivery consultants. Billable utilization and “productive” utilization often show up.

September 5, 2013 at 7:05 pm |

I’m trying to evaluate the “efficiency” of a firm (a subsidiary corp) and the “utilization” rate has crossed my desk, so to speak. Do you exclude the non-professional staff, such as admin and finance? Where would you get a reliable benchmark/industry standard?

September 15, 2013 at 7:42 am |

Fisnik:

You can analyze billable utilization of delivery staff to assess how efficient delivery resources are being managed. You can assess revenue per employee for the entire firm to assess the overall efficiency of the firm (balance of non-billable and billable resources). You can also look at the percentage of total revenues being allocated to COGS (cot to deliver projects) vs. non-billable categories such as G&A, Sales, and Service Operations. TSIA provides benchmarks on all of these metrics for technology professional service organizations.

September 14, 2013 at 6:01 pm |

Hi Thomas, thanks for the response. Understand and agree with the view point, however I actually KPI ‘Realisation Rate’ based on time, rather than finances. As my industry is predominantly ‘fixed fee services’ basis, I can then KPI my Consultants as they estimate the days in advance and then deliver the services.

I have decided to target them on utilisation as well, albeit with a very stretching target of 80 – 85% as this will drive them to have a customer focus. I have allowed for ‘external company funded training’ to count towards utilisation, as it is a stretching target and a 5 day external training course can kill that 85% target.

I appreciate the response.